LTC Planning in a Challenging Economy 2 (Case Study)

Part 2, is our Asset Care Recurring Premium w/ SPDR (Single Premium Drop-in Rider) solution.

Here is a recent case study:

MN residents, Nathan and Suzy (ages 53/51); Nathan an accountant and Suzy an owner of a successful bakery. Being younger and in good health, they knew it was a good time to plan now, after seeing the financial effects of an extended care event for Suzy’s grandmother with Alzheimer’s before passing recently. When they found out about OneAmerica’s “joint” LTC plans and the Lifetime benefit option; that was obvious solution they wanted to use with their $600/mo budget . They also liked that Waiver of Premium was a benefit of a Recurring Premium plan.

Due to Nathan’s line of work, he knew about the potential tax deductibility of LTC premiums if they ran the policy through Suzy’s business which aided in their ultimate decision.

Lastly, their advisor asked about Nathan’s Whole Life policy that his parents took out on him when he was younger, if they wanted to use the $42,000 of cash value to increase their LTC benefits, by doing a 1035 exchange? (using the SPDR) They asked for two quotes to make their decision.

Quick Summary of Quotes (attached)

- No SPDR

- 3% compounding inflation on AOB and COB for life

- Starting LTC Benefit of up to $2,726/ person ($5,451 if both on claim)

- LTC Benefit after 30 years of growth $6,616/person, ($13,232 if both on claim) continuing to inflate

- $90,851 Death Benefit, 2nd-to-die, if not needed (tax-free to beneficiary)

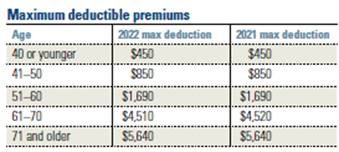

- LTC Premiums deductible up to age based caps (by running through the business, amount increases as they age, see chart below 2nd summary)

- All premiums, death benefit, and LTC benefits guaranteed

2nd Quote- Client’s chose this option

- SPDR of $42,000 cash value used in a 1035 exchange to strengthen LTC benefits (or could’ve been used to lower ongoing premiums)

- 3% compounding inflation of AOB and COB for life

- Starting LTC Benefit of up to $3,598/ person ($7,195 if both on claim)

- LTC Benefit after 30 years of growth $8,733/person, ($17,466 if both on claim) continuing to inflate

- $119,924 Death Benefit, 2nd-to-die, if not needed (tax-free to beneficiary)

- LTC Premiums deductible up to age based caps (by running through the business, amount increases as they age, see chart below)

- All premiums, death benefit, and LTC benefits guaranteed