Quick LTC Case Study: John Wrote 3 Cases and $1M in Premium by Just Doing this

We want to share a quick case study with you. John helped 3 clients create a Tax-Free bucket of LTC, wrote just under $1M of LTC annuity Premium in a few months, and had a pretty nice paycheck to boot!

John is an advisor in North Dakota. I met with John and we talked through the LTC Annuity Strategy.

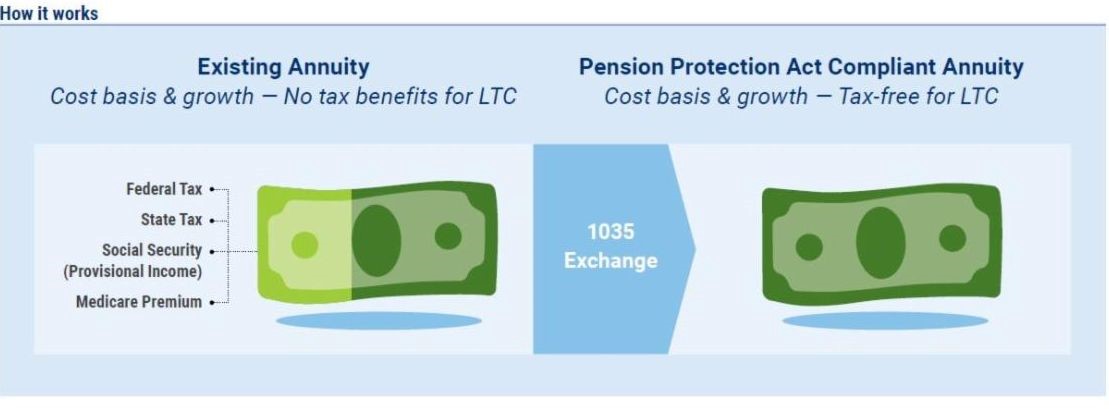

The advantages of the LTC Annuity are this:

- No Fees (unencumbered Growth)

- Tax-Free Distributions for LTC

- Takes a low basis annuity, and erases taxes on the gain if used for LTC

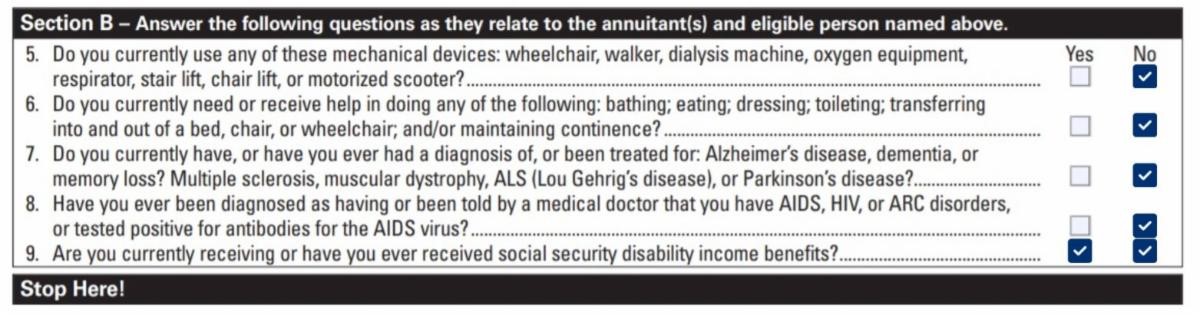

- No Underwriting (4 basic question Instant Approval)

- Up to age 87

- up t0 1.5M

Basically, a client can take an “old annuity” they have that isn’t being used and put it into another annuity that can pay out Tax-Free for LTC. The amount of gain does not matter- the more the better- making this attractive for older client in their 70’s and 80’s that have annuities they will not use. If nothing else, it gives them a “better” place to draw from if they need LTC.

John had a number of annuities on the books. John used our Client Profile to look through his older annuity list.

The Profile is very specific, and sticking to the criteria, John found 3 people he could talk to about this:

- 82 yr old Couple. 472K Annuity owned by the husband. Either person can use the money tax-free for LTC

- 77 yr old Couple. 350K Total that either can use for LTC. 189K owned by Wife, 161K owned by Husband. 350K.

- 84 yr old Female. Widowed. 170K she can use Tax-Free for LTC.

In Total, John wrote 994K in LTC Annuities by using the profile and just going through his book of annuities.

These clients hadn’t even heard of this strategy before John brought it to them. They were simply holding on to their old annuities, or just rolling them over to a new MYGA every time their previous term ended. They were” kicking the can down the road: with an asset they likely wouldn’t use.

We helped them put a plan in place for LTC- and a few of them weren’t even healthy; but they could pass the 4 questions.

A few others we’ve written recently doing the exact same thing:

Sarah in N Minnesota

- 87F 157K

- 81F 80K

- 87F 365K

Tom in Lincoln

- F 85 510K

- F 81 173K

Bill in SD

- M 74 440K

Frank in Minneapolis

- F 87 500K