Stay Alert with Athene’s Financial Crime Programs

Our goal is to provide valuable information on an ongoing basis that can help in your efforts to prevent, detect and combat financial crime. These resources can help you understand your obligations.

Anti-Fraud: Tech support scams

Tech support scams are a type of fraud where someone claims to offer legitimate technical support. The perpetrators of this scam may claim there is a serious problem with a client’s computer, such as a virus, to gain access and obtain information.

The Federal Trade Commission (FTC) advises that tech support scammers may …

- Call and pretend to be a computer technician from a well-known company and say they have found a problem with a client’s computer.

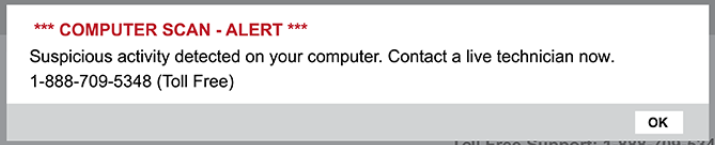

- Use pop-up warnings that appear on the computer screen alerting clients to a false security issue. The warning will include a phone number to call and get help.

- Try to get their websites to show up in online search results for tech support.

- Request remote access to the client’s computer to review cookies and obtain knowledge about the companies or financial institutions the client does business with. This method allows scammers to …

- Impersonate the client to change passwords and takeover an account. Or,

- Advise clients that their funds are at risk and need to transfer those funds to an account that has already been compromised.

The FTC also advises that …

- Legitimate tech companies will never initiate contact by phone, email or text message to advise there is a problem with a computer.

- Security pop-up warnings from real tech companies will never ask you to call a phone number or click on a link.

If you suspect your client may have been a victim of a tech support scam, please contact the Compliance Department at AMLFraudReferral@athene.com.

For additional information go to FTC.gov.

Anti-Money Laundering (AML): Customer Due Diligence (CDD) Rule

The Customer Due Diligence (CDD) Rule aims to improve financial transparency and uncover any illicit activities to prevent gains from being laundered.

The CDD Rule clarifies requirements for U.S. banks, brokers dealers and other financial institutions. The rule requires these institutions to identify and verify the identity of all individuals, including beneficial owners, who own 25 percent or more of a legal entity and/or controls and profits from a legal entity when accounts are opened.

The rule also requires financial institutions to establish and maintain written policies and procedures that are reasonably designed to:

- Identify and verify the identity of customers and beneficial owners opening accounts

- Help institutions of covered products understand the nature and purpose of customer relationships to develop customer risk profiles

- Conduct ongoing monitoring to:

- Identify and report suspicious transactions

- Maintain and update the existing customer risk profile information

Athene retains beneficial ownership information on all trusts, corporations, limited liability corporations, and partnerships. At a minimum, we will also obtain the following information for each beneficial owner before issuing an annuity or when adding another beneficial owner to the annuity contract:

- Name

- Date of birth

- Address (physical address)

- Identification number

For additional guidance, please refer to the Doing Business with Athene Producer Guide and the Producer’s Guide to Anti-Money Laundering.

Questions or concerns?

- When you suspect money laundering, please report the event to our Compliance department by emailing us at: AMLFraudReferral@athene.com.

- To report suspected fraud, please complete the Request for Compliance Review Form (16751).

- Additional Anti-Fraud information is available on Athene Connect.