Simplify Your Income Planning and Expand Your Client Pool at the Same Time

Right now, most agents are not targeting Gen X — and that oversight is your gain.

$5.9 trillion in investible assets are held by Gen X.¹

79% of Gen X households don’t have access to defined benefit plans.¹

That’s not even addressing Millennials or older Gen Zers who are working but not putting as much away for retirement yet. These post-Boomer generations are particularly underserved. Other agents just aren’t paying attention.

That’s where you come in.

You have a unique opportunity right at your doorstep – an open, younger market for you to cultivate.

20 YEAR FULLY GUARANTEED ROLL UP

Our updated Lifetime Income Benefit Rider (LIBR) Options 3 and 5* for IncomeShield™ 7,9 and 10 helps simplify income planning for you and your clients.

See IncomeShield in Action!

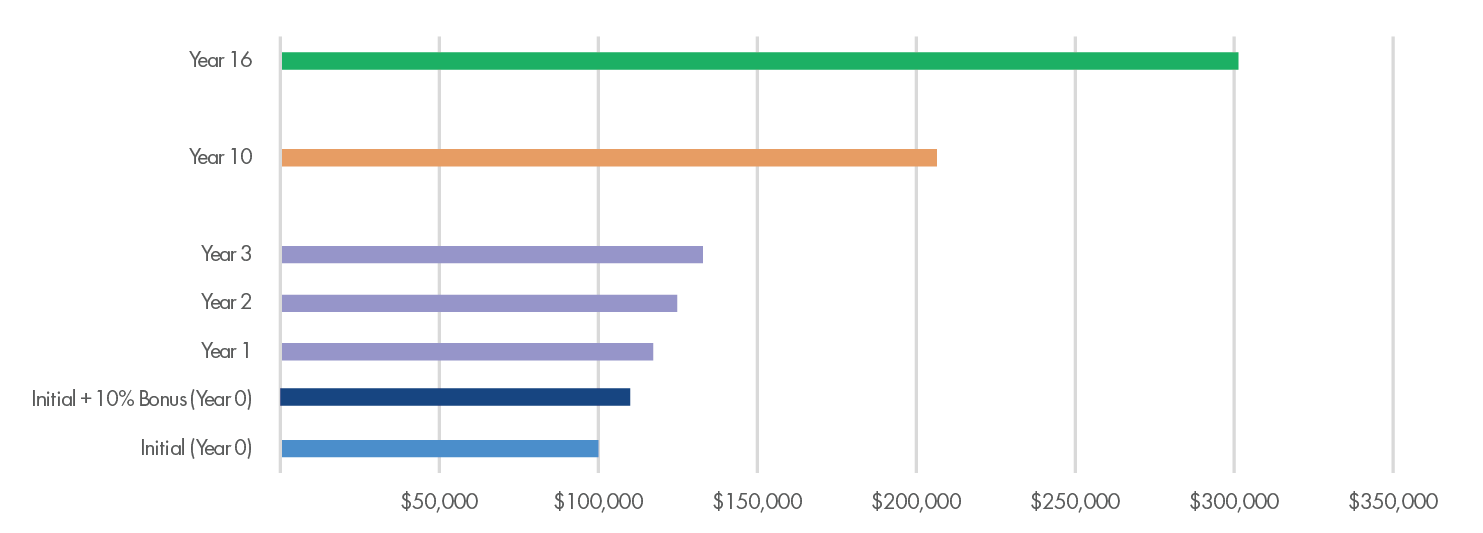

Let’s use IncomeShield 10 with its built-in 10% premium bonus to show you how this streamlined income-focused retirement works. If you start with $100,000, the bonus immediately turns that $100,000 into $110,000.**

With our 6.5% compound interest rate and its guaranteed accumulation period of 20 years, we can see this example IncomeShield 10 IAV double in Year 10 and triple in Year 16!

Example used for illustrative purposes only. Assumes no withdrawals are taken from the contract prior to income payments beginning. Excess withdrawals taken in addition to lifetime income payments will reduce future income payment amounts.

Learn how much IncomeShield 10 can empower your clients and help guarantee retirement income.

¹ The Retirement Reference Book, Fourth Edition, LIMRA Secure Institute, 2018

*Option 5 not available in CA

**Bonus available on 1st year premiums. Each year after the 1st contract year clients, become vested in a percentage of the bonus, until 100% vested at the end of the 10th contract year. Vested amounts of the bonus are the amounts not forfeited as a result of an early withdrawal or surrender. Bonus, surrender charges, and vesting schedules may vary by state. See brochure and disclosure for details.